Empower Retirement: Your Partner in Financial Security

Empower Retirement: Your Partner in Financial Security

Introduction

In today’s fast-paced and uncertain world, securing your financial future is more important than ever. That’s where Empower Retirement comes in. As one of the leading retirement plan providers, Empower Retirement offers a range of products and services designed to help individuals and companies achieve their financial goals.

Why Choose Empower Retirement?

1. Experience and Expertise

Empower Retirement has been in the industry for decades, providing retirement solutions to millions of Americans. With their vast experience and expertise, they have a deep understanding of the ever-changing financial landscape.

2. Customized Solutions

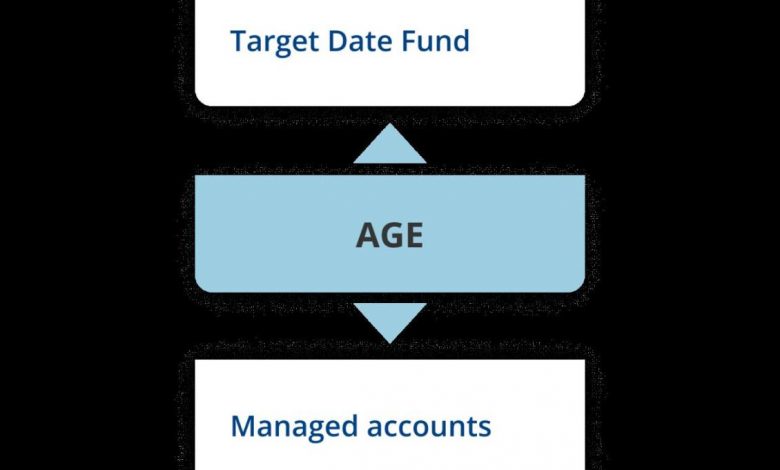

Empower Retirement understands that every individual and company has unique financial goals and needs. That’s why they offer customized solutions tailored to your specific situation. Whether you’re planning for retirement, managing 401(k) plans, or looking for investment options, Empower Retirement has you covered.

3. Cutting-Edge Technology

With Empower Retirement, managing your finances has never been easier. Their user-friendly online platform allows you to track your investments, evaluate your progress, and make informed decisions in real-time. You can also access educational resources and tools to enhance your financial knowledge.

4. Exceptional Customer Service

At Empower Retirement, they believe in building lasting relationships with their clients. Their customer service team is always ready to assist you with any questions or concerns you may have. Whether it’s a simple inquiry or complex financial planning, they are committed to providing exceptional service and support.

Frequently Asked Questions (FAQs)

1. How do I open an account with Empower Retirement?

Opening an account with Empower Retirement is simple and straightforward. You can visit their website and follow the instructions to get started. If you need assistance, their customer service team is just a phone call away.

2. What investment options are available with Empower Retirement?

Empower Retirement offers a wide range of investment options to suit different risk tolerances and financial goals. From mutual funds to index funds, stocks, and bonds, you can choose the ones that align with your investment strategy.

3. Can I rollover my existing retirement accounts to Empower Retirement?

Yes, Empower Retirement allows you to consolidate your retirement savings by rolling over your existing accounts. The process is seamless, and their team can guide you through the necessary steps.

4. Is Empower Retirement only for individuals, or do they also cater to businesses?

Empower Retirement serves both individuals and businesses. They offer employer-sponsored retirement plans, including 401(k) and 403(b) plans, as well as pension plans and other employee benefits.

Conclusion

When it comes to securing your financial future, Empower Retirement is your trusted partner. With their experience, customized solutions, cutting-edge technology, and exceptional customer service, they are here to help you achieve your financial goals. Take the first step towards financial security by choosing Empower Retirement today.

Remember, planning for retirement is a long-term commitment, so it’s essential to seek advice from a qualified financial professional to understand how Empower Retirement’s products and services fit into your specific financial situation.